Pinnacle’s client satisfaction surveys and independent third-party research show that we excel at meeting all of their needs and creating an experience they simply can’t get at any other financial services firm.

Greenwich Associates, the foremost provider of market research for commercial banks, recognized Pinnacle for the seventh consecutive year of its Greenwich Excellence Awards program. In all, Pinnacle won eight awards for distinguished service, including a sweep in the South region, where we won in every category for small business banking.

In addition, we received Greenwich Best Brand Awards for Ease of Doing Business and Trust, which signifies the confidence clients have in their bank. Awards like these show that we have truly built a competitive distinction versus the large regionals with whom we compete.

Financial advisors, board members and clients gathered for lunch and discussion at one of Pinnacle’s 2016 Forum events.

While these awards are validating, we find the most value in hearing directly from clients. Pinnacle is intentional about surveying clients to see what’s working and what we could improve. For our annual survey of clients with high-value relationships, we are proudest that 96.7 percent of respondents agree that “Pinnacle is recognizably better than its competition.” When we surveyed clients who opened new accounts, 97.8 percent of respondents called us better than our competitors.

The results of these various client satisfaction surveys confirm that we’re on the right track with the same business strategies we’ve employed since the firm’s inception:

Our deep relationships with business owners and their employees has helped us achieve extraordinary penetration of those segments. Greenwich Associates’ surveys of business owners show that Pinnacle consistently ranks at the top in each of our markets in terms of “ease of doing business” and “values long-term relationships.”

Again in 2016, we were the No. 1 small business lender in Middle Tennessee, according to the Nashville Business Journal. We also ranked No. 1 on the Knoxville News Sentinel’s list of Knoxville-area lenders of million-dollar real estate loans.

We recognize that business owners and their employees have personal financial needs, too, and we can meet them all. Every client has a dedicated Pinnacle contact—usually a banker (we call them financial advisors)—who can assemble a team of specialists to offer a customized solution depending on the situation.

Financial advisors for personal banking advise individuals or families on the best types of accounts for their deposit and borrowing needs. In 2016, we began a partnership with the Memphis Grizzlies, the NBA team in Tennessee, to give fans access to perks they can’t find anywhere else. As the official bank of the Memphis Grizzlies and FedEx Forum, Pinnacle offers Grizzlies-branded debit and credit cards, along with special promotions like tickets to a game when clients open a new Grizzlies Banking checking account. Our long-standing partnership with the Tennessee Titans is going strong, and fans of the NFL team in Nashville enjoy similar access with Titans Banking.

Our music and entertainment team brought their band, The Hummingbirds, with them when they joined the firm and played their first Pinnacle gig at our anniversary party.

Many of Pinnacle’s business financial advisors have expertise in certain industry sectors, such as the legal field; key business functions, such as cash-flow management; or certain market segments, such as middle-market businesses. In 2016, we gained the best music and entertainment team in the country through our acquisition of Avenue Financial Holdings.

Our mortgage and commercial real estate advisors are experts in their markets and guide clients through the process.

Our wealth management capabilities best demonstrate Pinnacle’s intent to be “more than a bank.” Wealth management associates help clients accumulate, preserve and distribute assets through financial planning, investment management, trust and insurance services.

Our competitive distinction is our people. We set out to find and bring on board the most successful financial services professionals in our markets. Only highly experienced associates can give the level of service that our clients deserve.

Pinnacle’s financial advisors have a track record of success in Nashville, Knoxville, Chattanooga and Memphis, averaging 23 years of experience. Clients know that they can expect long-term relationships with their partners at Pinnacle, given our retention rate of nearly 93 percent. Our hiring pipeline is stronger than it’s ever been. In 2016, we recruited 51 client-facing advisors, plus an additional 30 who were part of the Avenue acquisition. That’s a significant increase from 2015’s record of 36 revenue producers.

We brought on the most experienced financial services professionals in Chattanooga when we acquired CapitalMark Bank & Trust.

These new associates increased our capabilities in areas such as ultra-high-net worth individuals (Pinnacle Wealth Advisors) and deepened our bench strength in segments like commercial real estate and residential mortgage lending.

Our financial advisors are more than willing to share their insights with those who are interested in taking their businesses to the next level. As Nashville- and Knoxville-based associates have done for years, our newest financial advisors in Chattanooga and Memphis have begun to host their own Mastermind groups—small groups of business owners who meet in one of our offices once a week for eight consecutive weeks exploring ways to grow their businesses.

Our advisors’ vast backgrounds in financial services and key leadership positions in the communities we serve continue to enhance Pinnacle’s team. Their personal interactions with clients, along with word-of-mouth referrals, continue to be the primary reason we’re one of the fastest growing banks in America. No amount of advertising or mass marketing could replicate the results we get from investing in the most qualified professionals.

Distinctive service. Effective advice. That’s our brand promise, and it’s what associates offer clients every day. We also strive to make banking with us as convenient and easy as possible.

When do you ever get a live person when you call a business these days? At Pinnacle, having someone answer the phone within three rings during business hours is still a must. But that’s just expected. We also go out of our way to anticipate a client’s unspoken needs and do something memorable, whether it’s replacing a designer handbag after it was stolen with the debit and credit cards inside or turning one of our offices into a theater for a local group of developmentally disabled adults’ “Movie Day.”

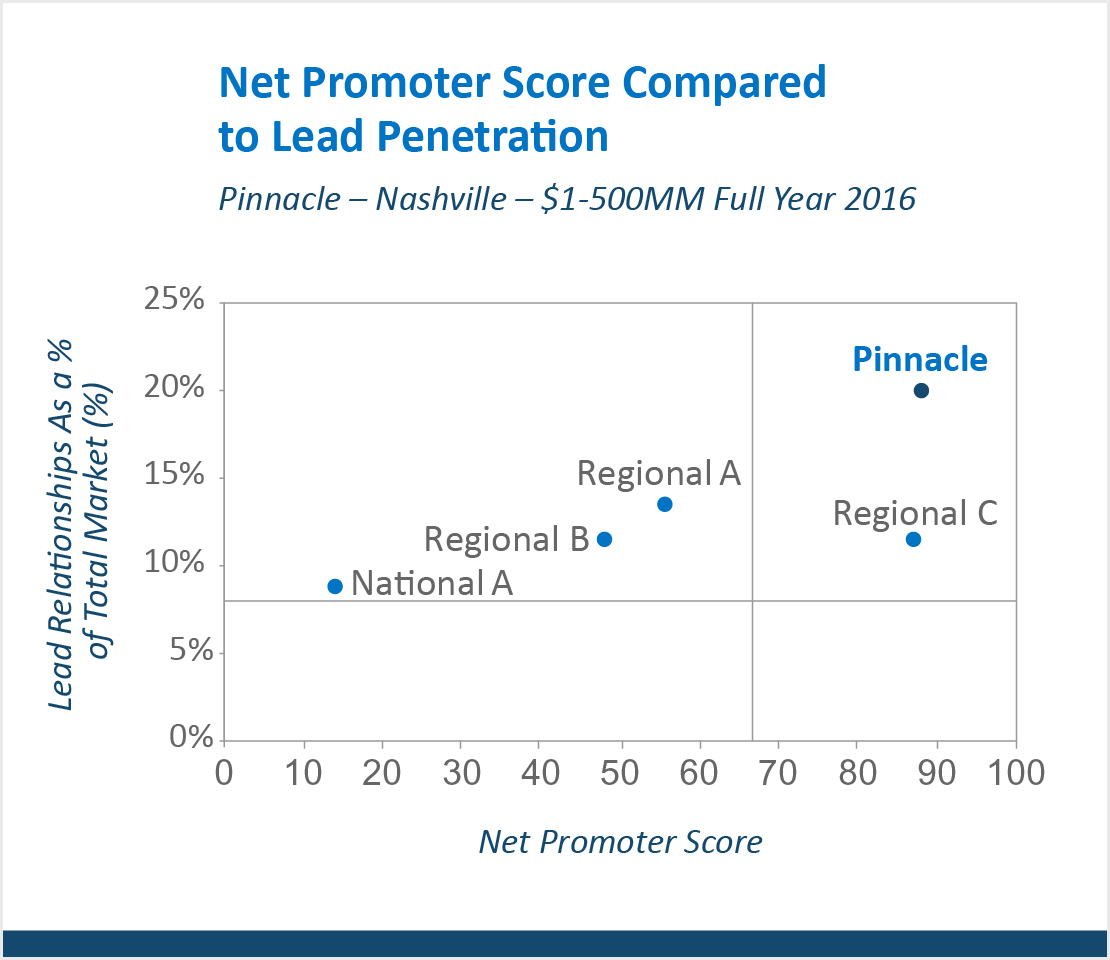

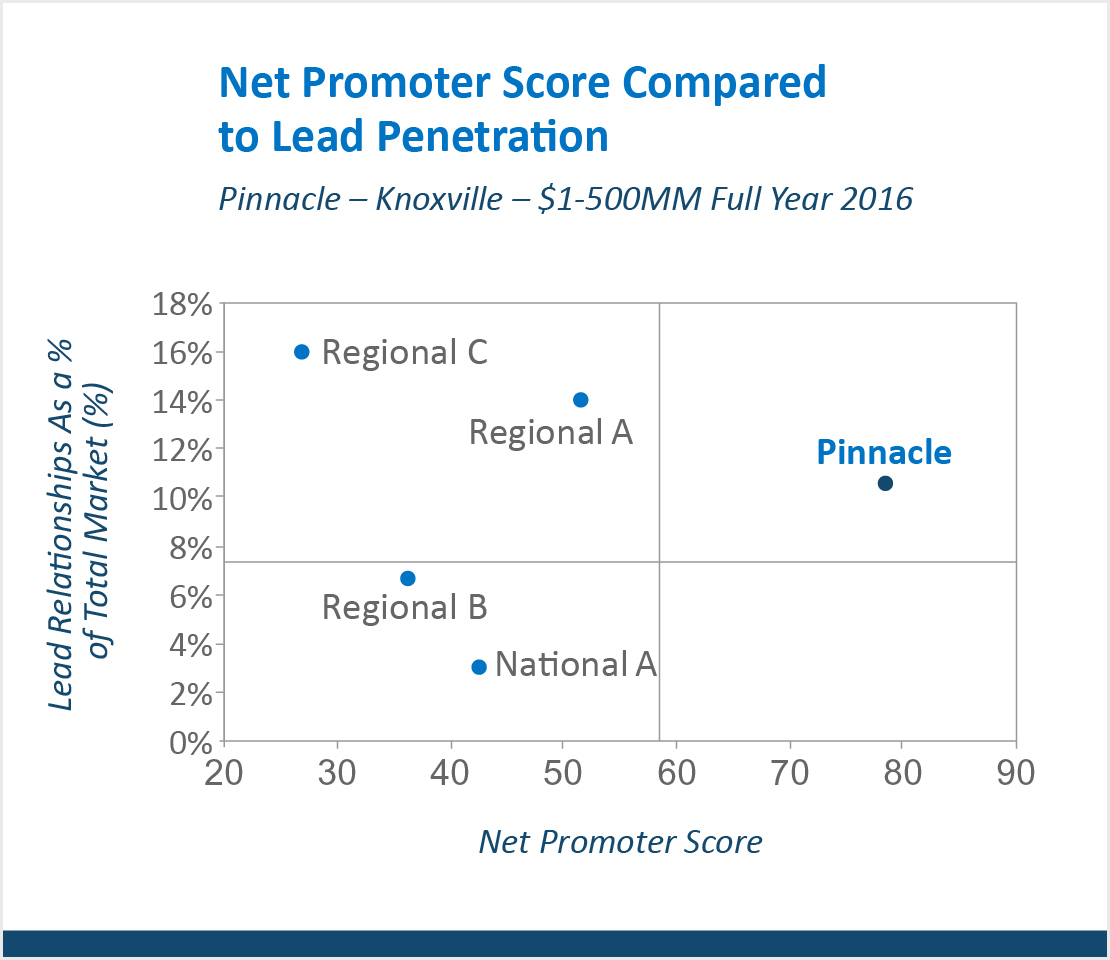

That level of service leads to extraordinary client loyalty. In our legacy markets of Nashville and Knoxville, our “net promoter score,” which measures how willing our clients are to recommend us, is extremely high for our market penetration. That’s the kind of client engagement we are striving for.

Note: Cross-hairs are set at the mean for lead penetration (Y-axis) and NPS (X-axis). Net Promoter Score equals Promoters minus Detractors. Evaluations are based on a 0-10 scale, "0" not at all likely to "10" extremely likely. Promoter = 9,10; Passive = 7,8; Detractor = 0-6.

Question: How likely are you to recommend (Lead Bank) to a friend or colleague using a scale of 0-10 where "0" means Not At All Likely and "10" means Extremely Likely? Which bank or financial service provider do you consider your company's single most important or lead provider of banking services?

Source: 2016 Greenwich Associates Market Tracking Program (Pinnacle - Nashville - $1-500MM - Full Year 2016).

Note: Cross-hairs are set at the mean for lead penetration (Y-axis) and NPS (X-axis). Net Promoter Score equals Promoters minus Detractors. Evaluations are based on a 0-10 scale, "0" not at all likely to "10" extremely likely. Promoter = 9,10; Passive = 7,8; Detractor = 0-6.

Question: How likely are you to recommend (Lead Bank) to a friend or colleague using a scale of 0-10 where "0" means Not At All Likely and "10" means Extremely Likely? Which bank or financial service provider do you consider your company's single most important or lead provider of banking services?

Source: 2016 Greenwich Associates Market Tracking Program (Pinnacle - Knoxville - $1-500MM - Full Year 2016).

We feel so strongly about our core value of learning that we provide educational opportunities for anyone who is interested. Associates and outside experts offer insights into a variety of topics at free workshops that take place in Pinnacle’s offices. In 2016, 20 workshops focused on issues such as advanced estate planning techniques, the role of annuities in a portfolio and labor laws for small business owners.

Clients learned more about the local economy and plans for future growth at Pinnacle’s Forum with new Nashville Mayor Megan Barry.

Giving clients access to economic, political and financial experts builds on the effective advice our own advisors provide. The 2016 Pinnacle Forum Series brought in leading outside speakers like nationally renowned economist Art Laffer, presidential historian Jon Meacham and Nashville’s new mayor Megan Barry.

We recognize that small businesses have many learning needs, but they don’t necessarily have the deep pockets to invest in sophisticated systems or conferences and consultants. That’s why we partnered with Lipscomb University to launch Pinnacle Pro, a professional development platform for business owners and their employees. For a nominal fee, businesses have access to a wealth of resources they need to solve an immediate need and for long-term growth.

Pinnacle is the second-largest bank holding company headquartered in Tennessee with 45 offices in the state’s four largest markets—Nashville, Memphis, Knoxville and Chattanooga—as well as several surrounding counties.

Because it’s not always easy to find time to come to an office, Pinnacle also offers mobile banking applications that let clients check their balances, transfer funds and deposit checks on the go. An updated design for Online Banking makes it even easier for clients to find the account information they need. With these digital capabilities and our remote deposit service for businesses, clients can bank with Pinnacle virtually anytime, anywhere.