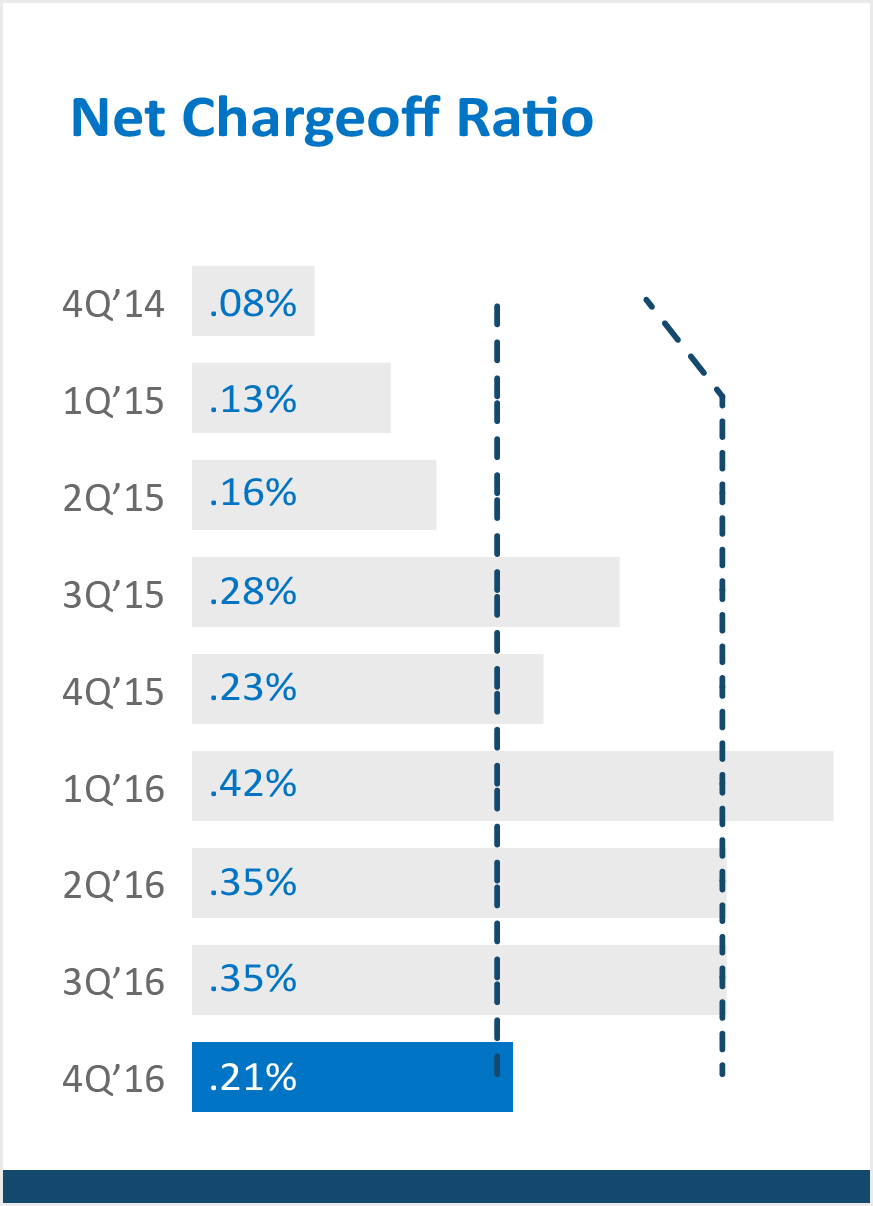

In 2016, we continued to grow the revenue and earnings capacity of the firm, we continued to grow the balance sheet—which we believe is predictive of future revenue and earnings growth—and our asset quality was excellent. We watch revenue growth, earnings growth and asset quality closely because we believe those three are the most important stock valuation drivers.

On a GAAP basis, our 2016 fully diluted earnings per share was approximately $2.91, up more than 15 percent from 2015. When merger-related charges were excluded, fully diluted EPS was up over 17 percent from 2015, at approximately $3.07. In addition, our revenue per share is up 20 percent from 2015. We believe our firm has performed exceptionally well and successfully turned revenue growth into bottom-line results.

Loans at the end of 2016 were a record $8.450 billion, reflecting year-over-year growth of 29.1 percent, which leads us to believe we can generate earning assets organically at an outsized rate. Average deposit balances at the end of the year were a record $8.791 billion, which is 29.5 percent more than year-end 2015.

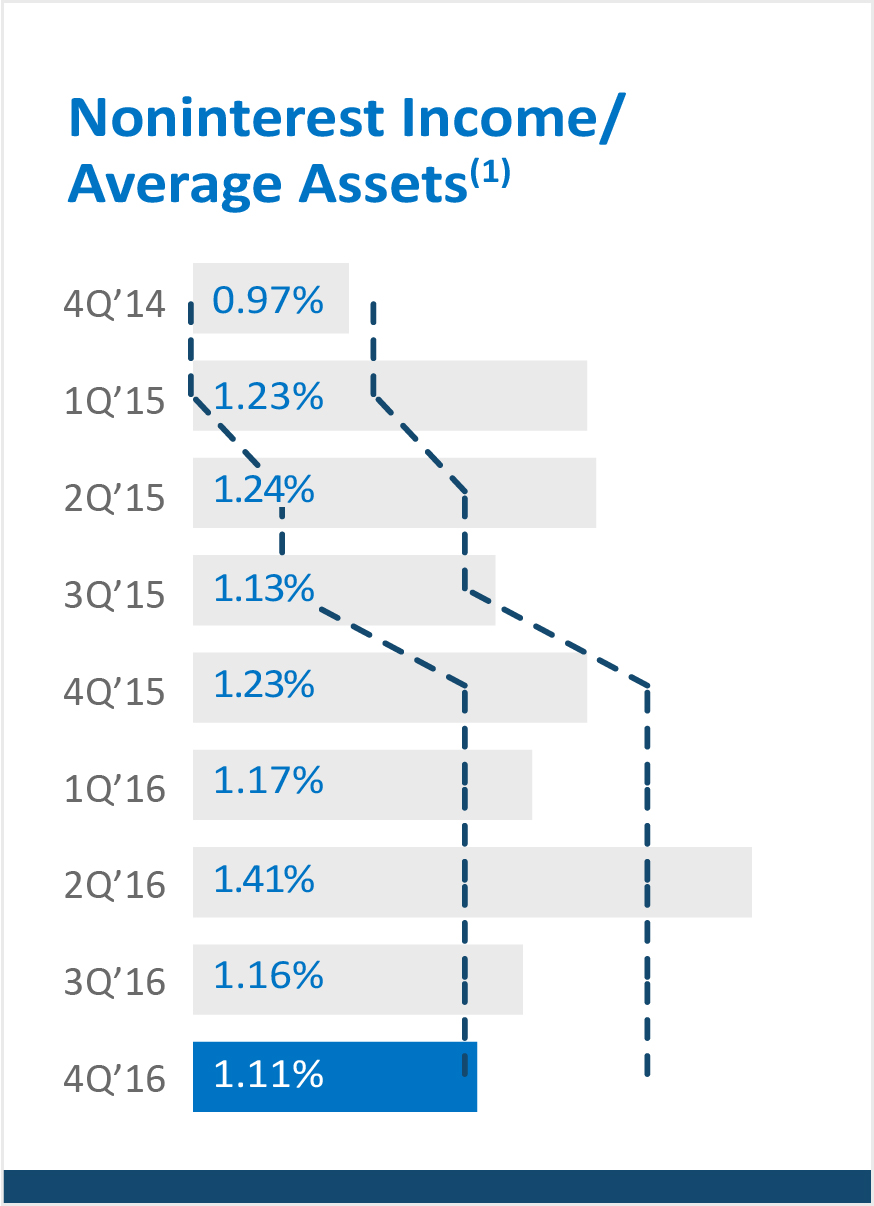

In 2016, we purchased an additional 19 percent stake in Bankers Healthcare Group, bringing our total investment in the specialty lending company to 49 percent. That ownership interest helped to increase our noninterest income by 52.5 percent over the amount reported for the end of 2015. Our year-end wealth management revenues, which include investment, trust and insurance services, grew by 16 percent over Dec. 31, 2015.

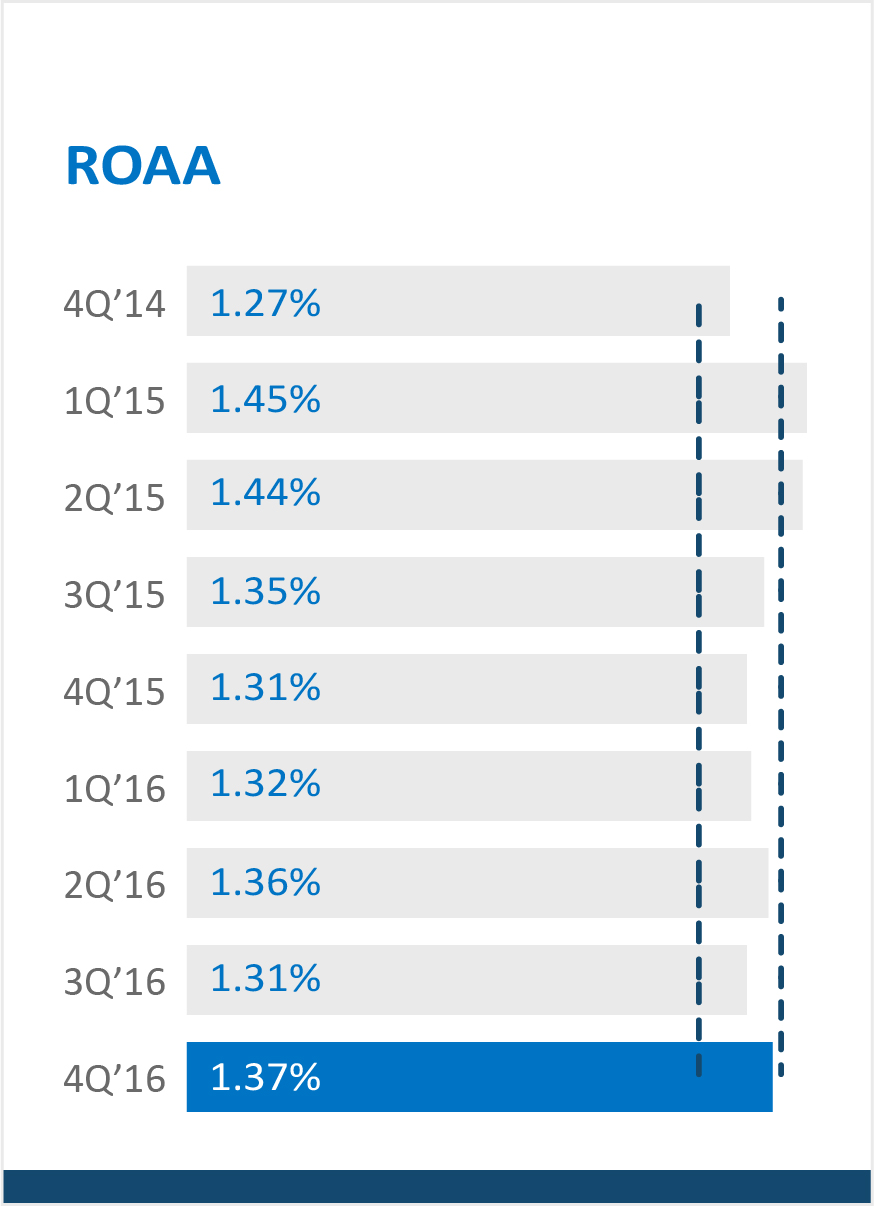

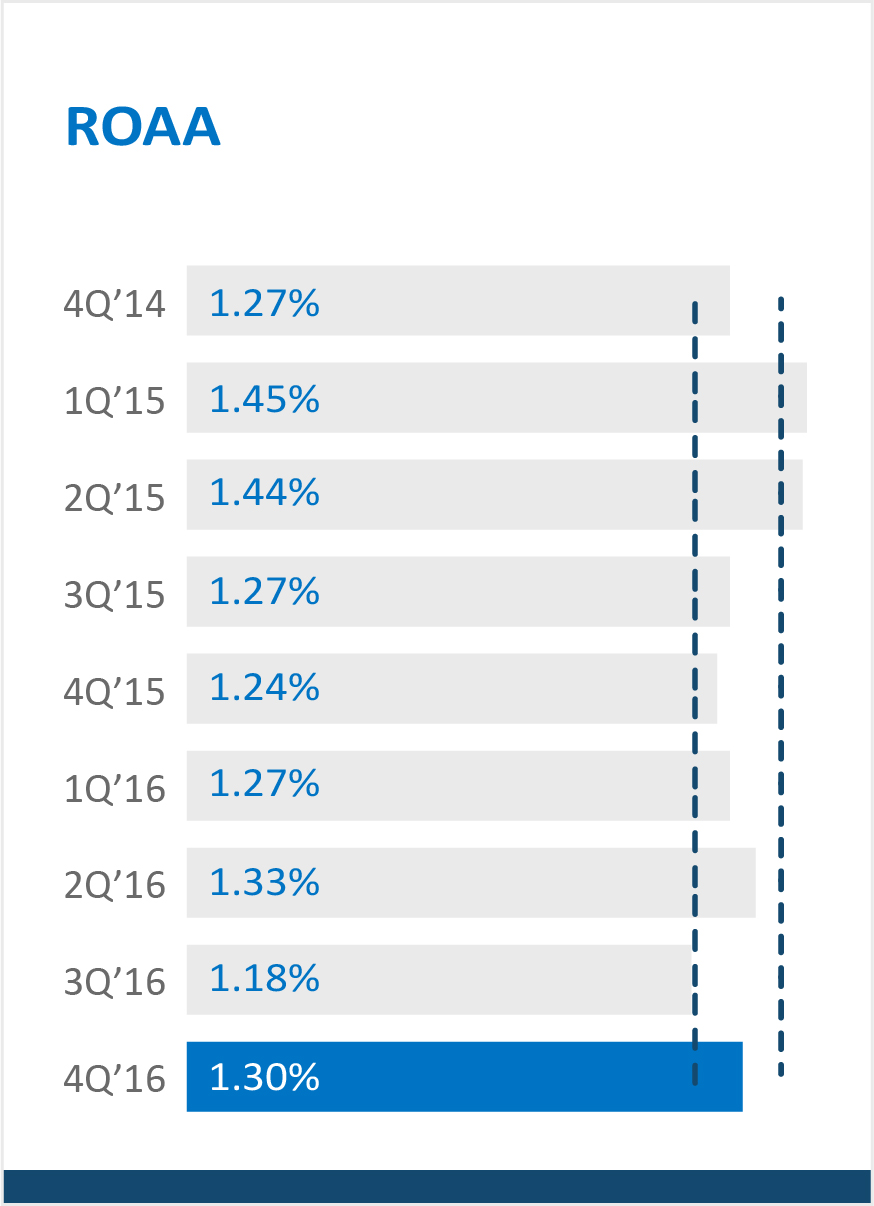

Coming out of the Great Recession in 2011, we published our profit model and associated performance targets. Since then, we have consistently performed near the target range for each measure and actually increased the return on average assets range to its current level of 1.20 to 1.40 percent.

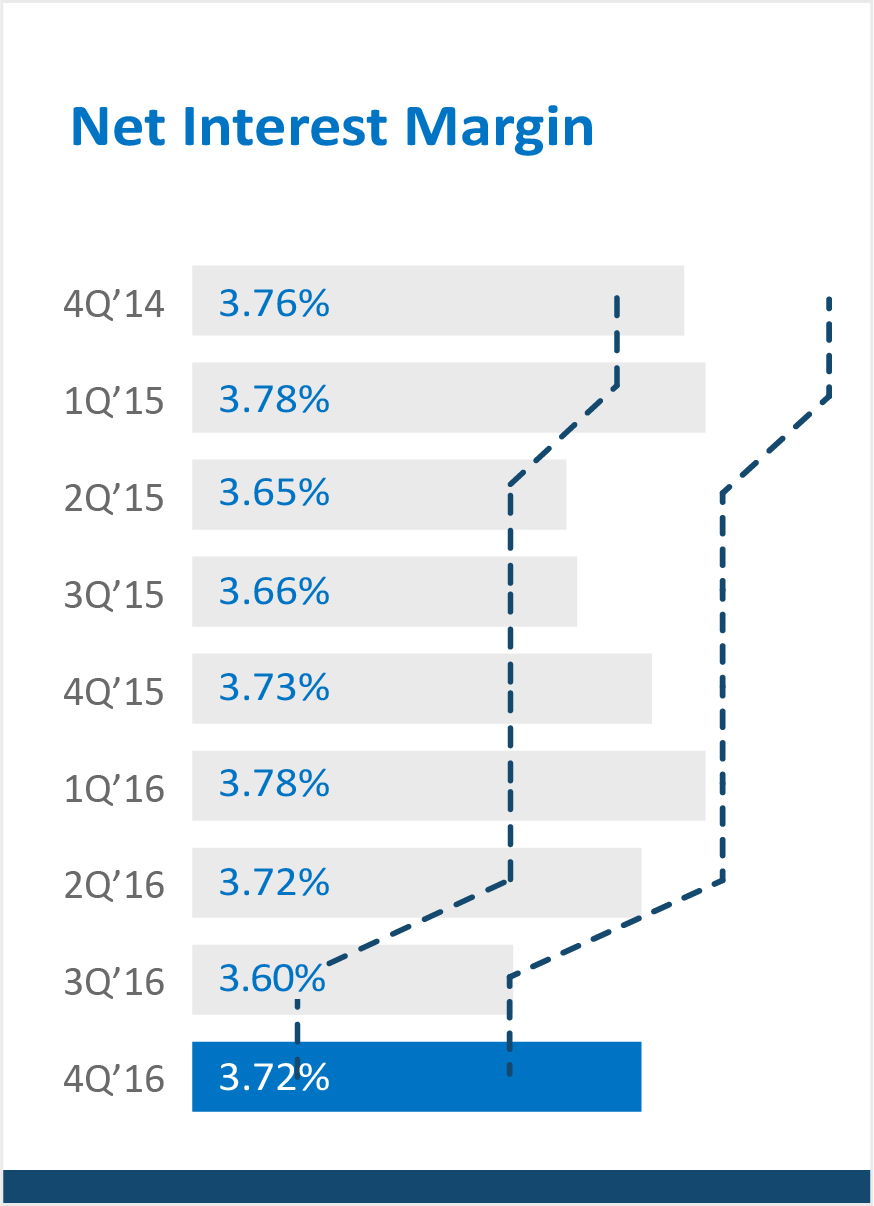

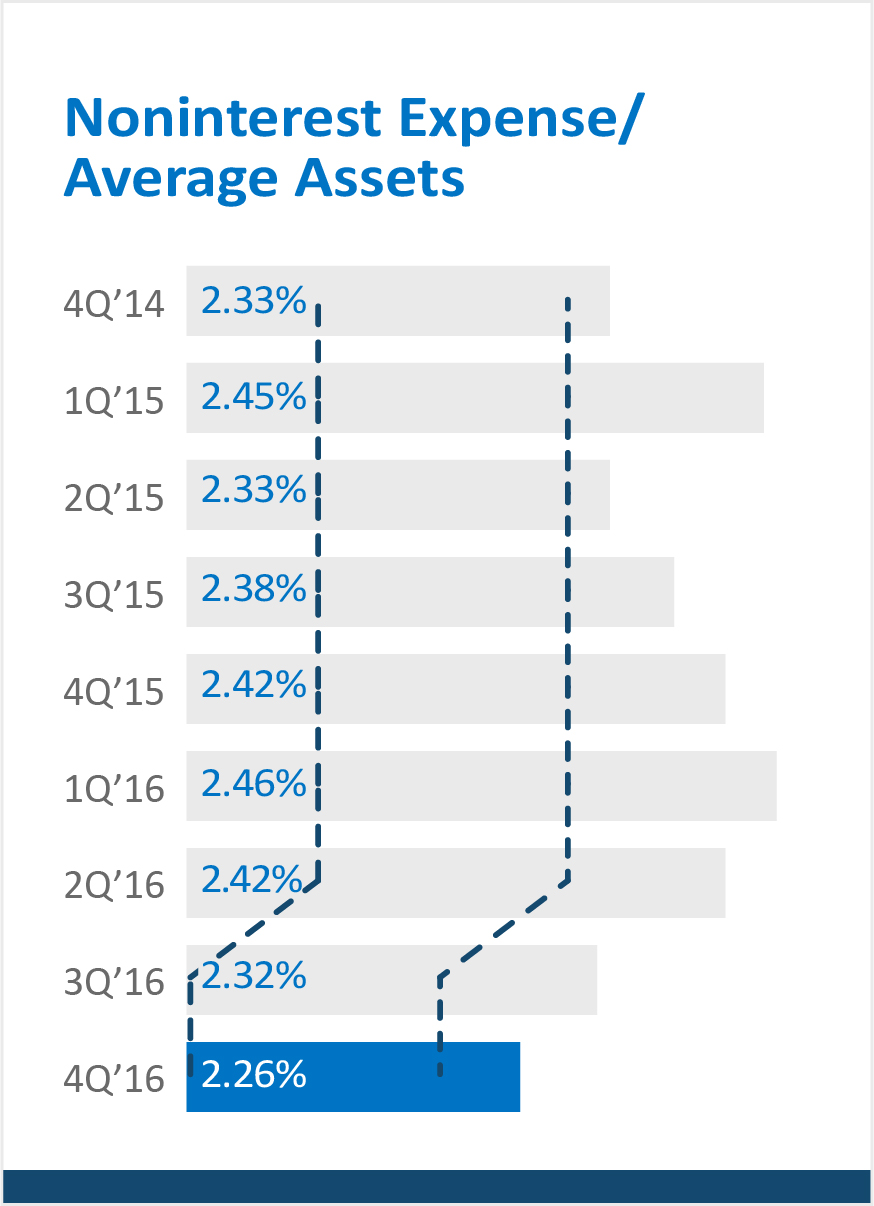

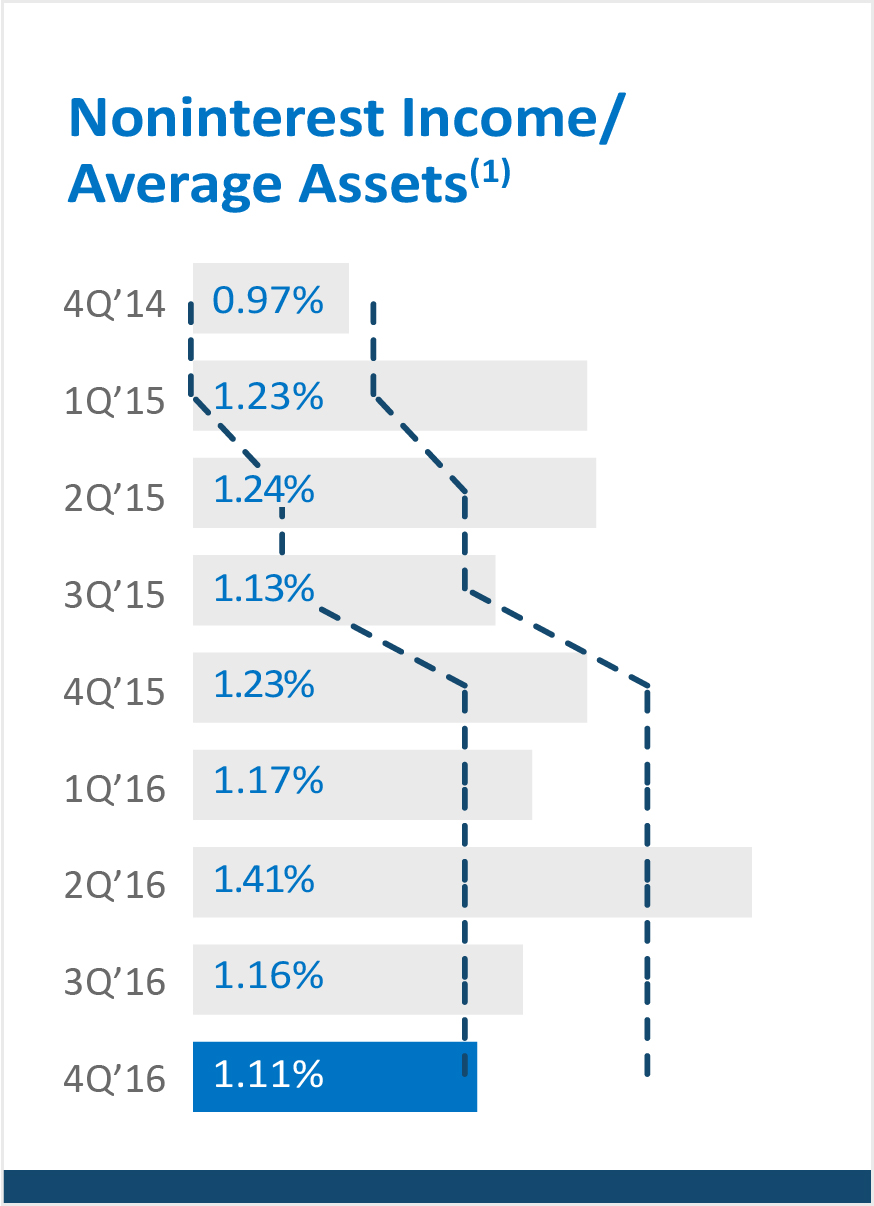

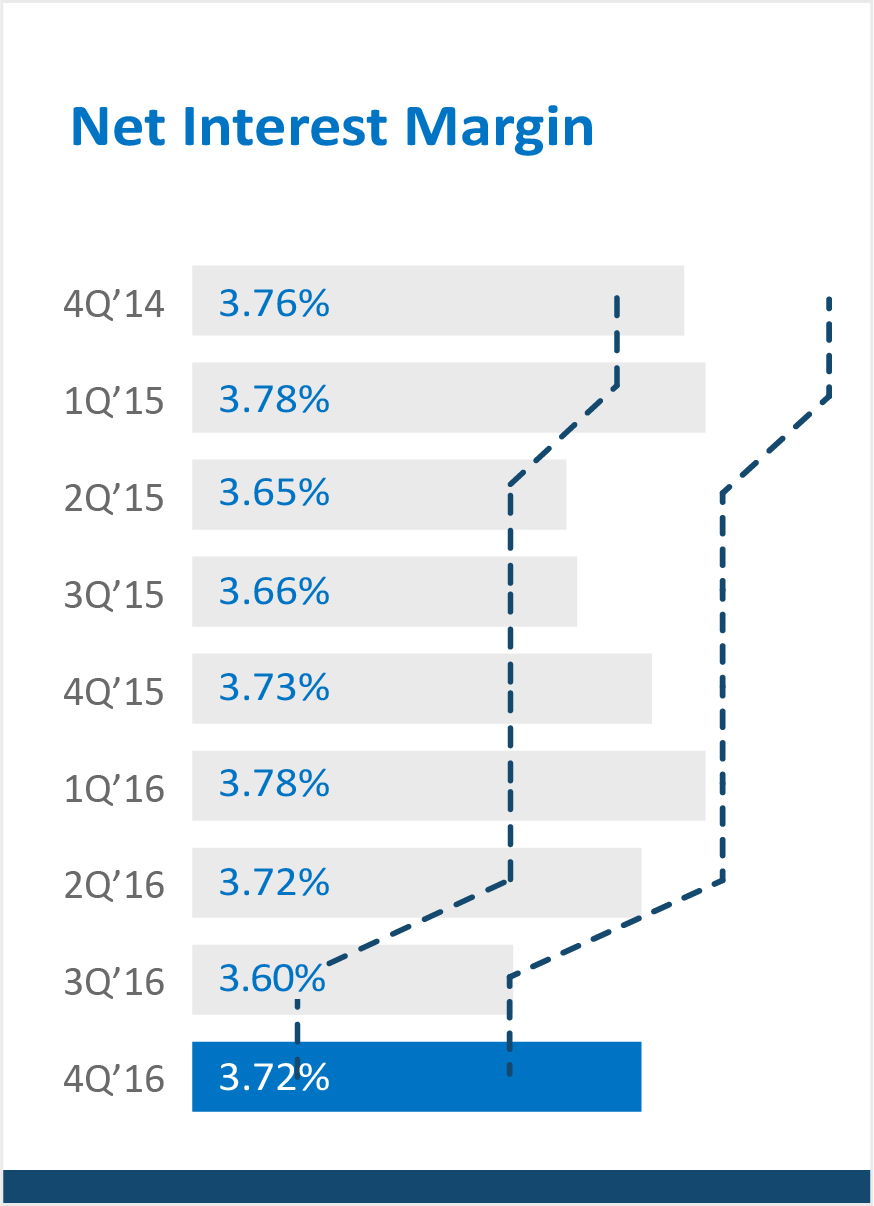

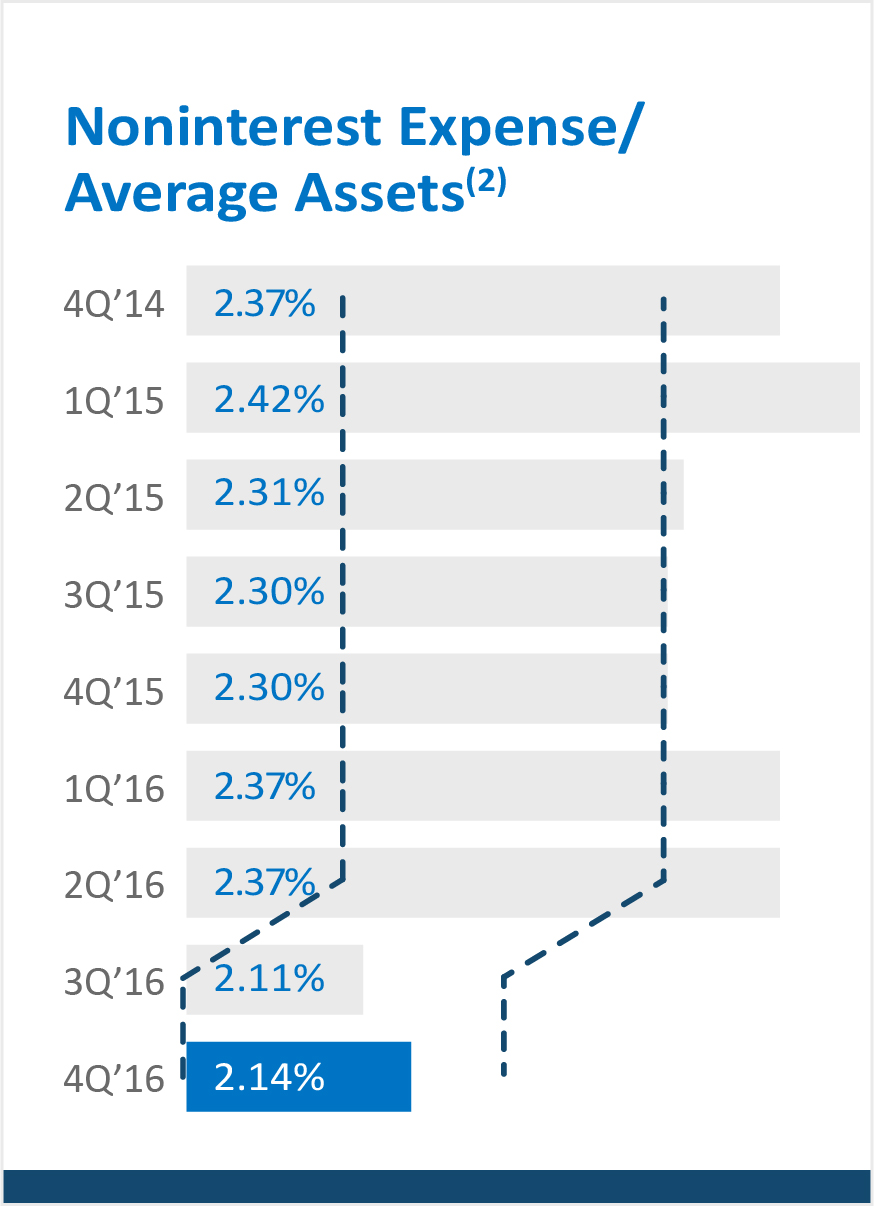

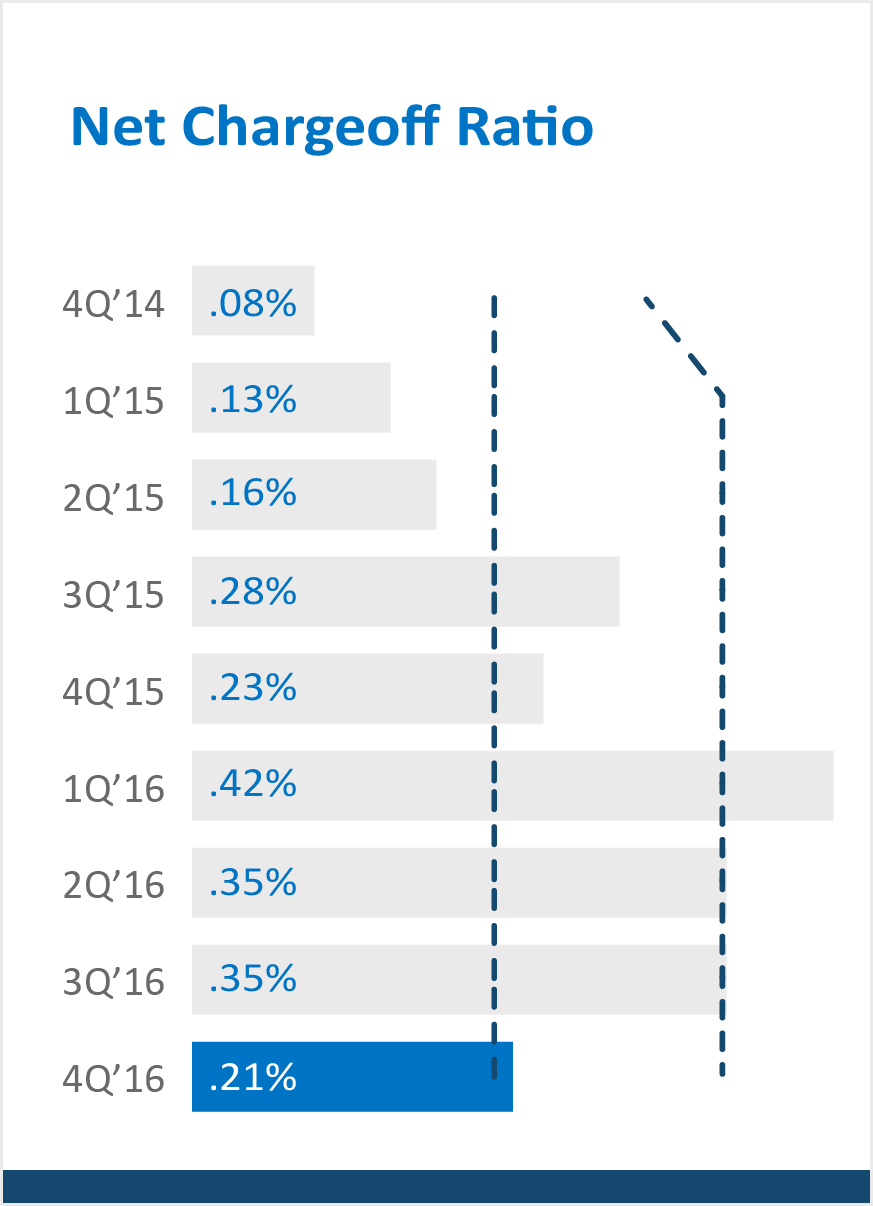

We continue to publish the targets for the key performance measures that would result in the firm’s overall profitability—specifically the margin, fees to assets, expenses to assets and net charge-offs.

We ended 2016 with an ROAA of 1.30 percent, or 1.37 percent excluding merger-related charges, which is near the top of our range. The net interest margin is up meaningfully over the third quarter of 2016 and actually above the targeted range. Fees to assets, expenses to assets and net charge-offs are all operating inside targeted ranges.

2016 was another phenomenal year for Pinnacle’s stock, with shares rising 42.2 percent over 2015.

When personal finance technology firm SmartAsset analyzed stock price, volatility and dividends of public companies across all industries in Tennessee from December 31, 2010 to March 31, 2016, it found Pinnacle to be the No. 8 top stock performer in the state.

We believe this is further proof that our focus on creating a great work environment and delivering outstanding service to clients leads to outsized shareholder returns.

We remain committed to building shareholder value using our strategic approach to soundness, profitability and growth while capitalizing on our advantaged stock. Throughout 2015 and 2016, we’ve been able to effectively deploy our highly valued stock to accelerate growth through acquisitions of some of the most attractive high-growth banks in the urban markets of Tennessee in terms of profitability and fit with our firm.

One of the most critical factors in our approach to creating long-term shareholder value is aligning associates’ interests with shareholders’ interests. Our associates take pride of ownership in this firm because they are owners. Three commitments ensure that everyone involved with the firm has a stake:

We expect that all of our shareholders will continue to reap the rewards from this strong alignment and the long-term results it should continue to deliver. We also remain confident in our longstanding formula for success—that our excited associates will continue to engage clients and that those engaged clients will enrich shareholders and produce outsized returns.

Tennessee continued to add jobs at more than twice the U.S. rate in 2016. The number of new business filings in the state has risen each quarter for the past five years. Within Tennessee, Pinnacle operates in the state’s four urban markets—Nashville, Knoxville, Memphis and Chattanooga.

Combined with Avenue, Pinnacle now holds the third-largest market share in Nashville behind one national franchise and one large regional headquartered out of state, making us the largest locally owned alternative for clients and solidifying our position as “Nashville’s bank.” The firm has quickly grown to be the sixth-largest financial institution in the Knoxville market after a 2007 de novo expansion into the area. After our mergers with CapitalMark Bank & Trust and Magna Bank, Pinnacle has the No. 4 market share position in Chattanooga and No. 11 share of deposits in Memphis. Having achieved No. 3 status in Nashville, the firm’s long-term goals are to grow to a top-three position in each of the four markets in which we operate.

Nashville continues to receive national attention for its quality of life, cultural scene and business startups. The city’s diverse economy and strong business community are major attractions for corporations. Economic development accolades in 2016 include:

Knoxville also enjoys an extremely healthy and diverse economy with an excellent transportation and technology infrastructure. Among Knoxville’s rankings in 2016:

Memphis offers a diverse, metropolitan workforce. Over the past three decades, the presence of companies like FedEx and the region’s superior distribution infrastructure have earned Memphis the title, “America’s Distribution Center.”

Chattanooga is Tennessee’s fourth-largest MSA as measured by both population and deposits. National publications have declared Chattanooga a tech hub and manufacturing magnet. Economic drivers include: